Experienced. Innovative. Focused. We are Patriot.

Our team knows banking.

We bring extensive transaction, operating and strategic expertise to help propel our companies forward.

Patriot Value Creation

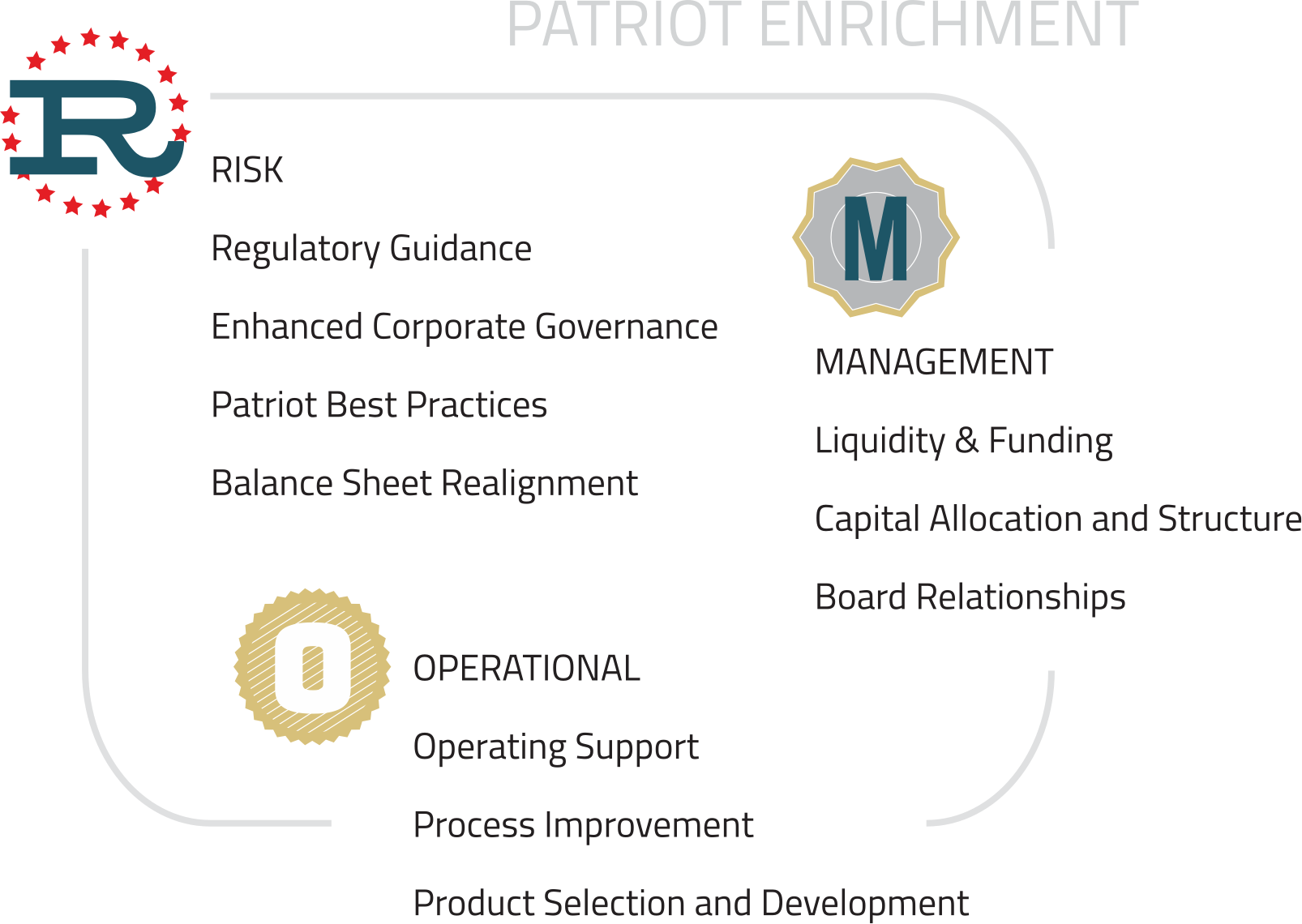

Patriot pioneered an approach to value creation that strengthens core operating principles to fuel innovation and help accelerate growth in each portfolio company. Our proprietary best practices, operating executives and subject matter experts with experience across key practice areas work to adapt a unique value creation strategy to support each company, driving advances in banking and the digital economy. We are a partner, helping banks and financial technology companies create better businesses and enduring market value opportunities.

THE PATRIOT ADVANTAGE

People

We are bankers and operators at our core, translating ideas into action.

Network

Our operations, growth and technology are personalized through thoughtful exchange across our network

Expertise

We know banking and bank technology. We have a track record of investing with a focus on growth & innovation.